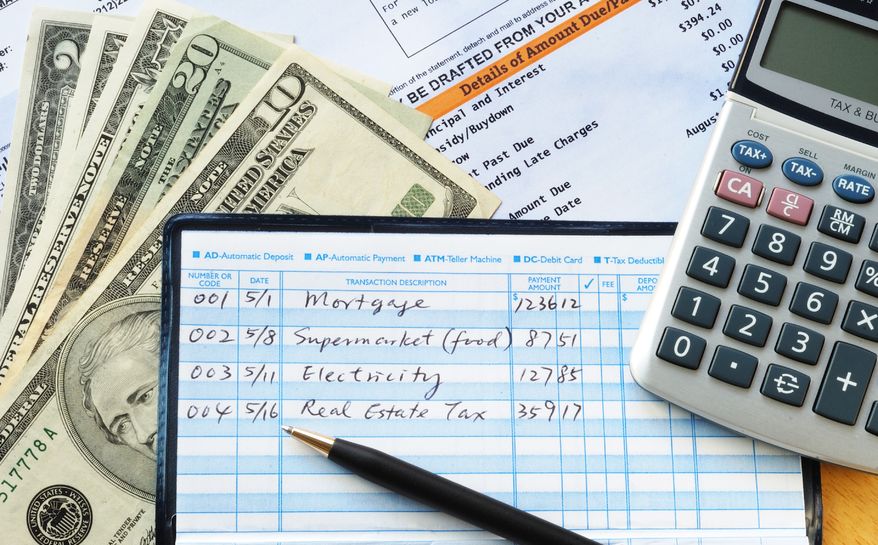

Tips to Keep that Checkbook in Balance

Are you making your bank account work for you? These days, checking accounts come with a variety of features, such as mobile alerts, that can help you take control of your finances and better manage your spending and saving. Are you taking advantage of them?

The recent Bank of America Trends in Consumer Mobility Report found that while consumers are widely adopting online and mobile banking, less than one-third are using the mobile alerts feature for their finances.

Follow these tips to ensure you’re getting the most out of your banking relationship:

* Stay in-the-know with mobile alerts. Many banks offer banking alerts via email or text that notify you when your balance is low, if a bill is due, when your paycheck is deposited and more. Alerts are a great way to keep track of the funds in your account and help avoid overdrafts and late payments.

* Set up direct deposit. One of the easiest ways to get the most out of your checking account is by setting up direct deposit. With direct deposit your money is quickly and securely deposited into your account, and banks often use this feature as a qualifier to avoid monthly maintenance fees.

* Track your spending using online and mobile banking. Online and mobile banking are simple and easy ways to keep an eye on your account balance and spending. With your computer or smartphone, you can securely bank almost anytime, virtually anywhere. Many online and mobile banking services also enable you to transfer funds from your savings account to your checking to ensure purchases are covered.

* Use a debit card. Debit cards allow you to access your checking account conveniently and securely, without having to carry a lot of cash. You can use a debit card at a variety of locations worldwide or at ATMs for deposits, withdrawals or transfers between accounts. What’s more, debit cards offer security if your card is lost or stolen or if fraudulent transactions occur.

* Pay your bills online, write fewer checks. Online bill pay provides an easy and convenient alternative to writing checks. Whether you’re paying the phone bill or paying back a friend for dinner, doing so with online banking keeps an electronic record of your balance, and eliminates the uncertainty of writing checks and waiting for them to be cashed.

* Learn how to help avoid overdrafts. It can be easy to lose track of your money when you’re busy balancing everyday life. You can help avoid overdrafts and the fees that come with them by keeping a close eye on both your account balance and the money you plan to spend. Some banks are directly addressing this challenge by offering new accounts that specifically help protect customers from overdrafts, such as SafeBalance Banking from Bank of America.

“Some customers are seeking more predictability in the way they bank, and that includes preventing overdraft fees,” says Titi Cole, retail products and underwriting executive for Bank of America. “It is important for customers to know that there are accounts available to help you spend only what you have.”

Using these convenient account features can make your life and your relationship with your money much simpler and more productive. To learn more, visit www.bankofamerica.com, Member FDIC.

Connect with us: Facebook – Twitter – LinkedIn – YouTube – Pinterest – Google+ – HOUZZView Our Communities – View our available new home floor plans – View our photo gallery

Sorry, the comment form is closed at this time.