Trader Joe’s or Whole Foods – Who Gives the Best Home Value?

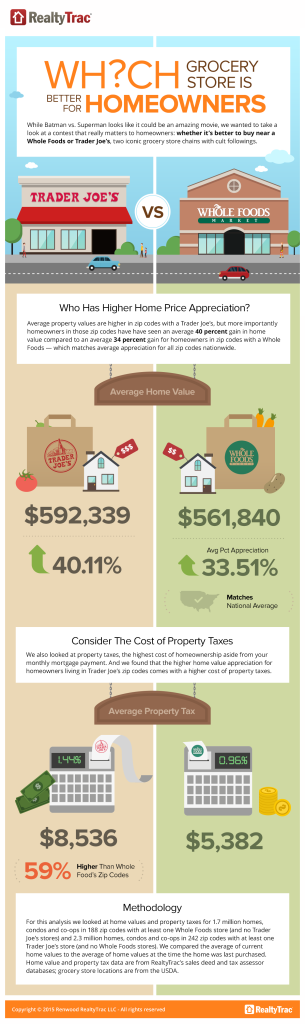

Two of our most basic needs as humans are food and shelter, and a recently released RealtyTrac report takes an enlightening look at an analysis combining these two elements. For this analysis, RealtyTrac looked at home values, appreciation and property taxes in U.S. zip codes with a Whole Foods or a Trader Joe’s to determine the best combination of food and shelter when it comes to these two iconic grocery store chains with cult followings.

What they found is that homeowners near a Trader Joe’s have experienced better home value appreciation since their purchase, but also pay higher property taxes on average.

Here are the details:

- Homeowners near a Trader Joe’s have seen an average 40 percent increase in home value since they purchased, compared to 34 percent appreciation for homeowners near a Whole Foods.

- Average appreciation for all zip codes nationwide is also 34 percent.

- Homes near a Trader Joe’s also have a higher value on average: $592,339, 5 percent more than the $561,840 average value for homes near a Whole Foods.

- The average value of homes was $262,068 across all zip codes nationwide.

- Homeowners near a Trader Joe’s pay an average of $8,536 in property taxes each year, 59 percent more than the $5,382 average for homeowners near a Whole Foods.

- The average property tax across all zip codes nationwide was $3,239.

For more information, visit www.realtytrac.com.

Connect with us: Facebook – Twitter – LinkedIn – YouTube – Pinterest – Google+ – HOUZZView Our Communities – View our available new home floor plans – View our photo gallery

Sorry, the comment form is closed at this time.