Good mortgage laws in Texas helped Texas’ housing values hold up in the face of this country’s worst recession since the Great Depression

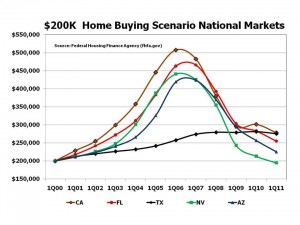

Loren Steffy’s story in the Houston Chronicle does a good job of describing how good mortgage laws in Texas helped Texas’ housing values hold up in the face of this country’s worst recession since the Great Depression. While many people in states like California, Florida, Nevada and Arizona were refinancing their homes to take out their equity (at the top of the housing market) after a 5 year run up of unsustainable appreciation (the housing bubble), Texans were capped @ 80 percent. The graphic below gives an example of home price appreciation for a hypothetical $200,000 house purchased in each state in the first quarter of 2001, according to the figures from the Federal Housing Finance Agency.

We should all appreciate the good mortgage laws in Texas and the “steady as you go” housing appreciation we enjoy as illustrated in the graph below. Outside of Texas, only California home values are showing signs of stabilizing.

Besides better mortgage laws, Texas has fewer regulations on new housing development which helped us avoid a shortage of homes that forced up home prices in those other states. The state’s ability to increase housing supply to meet demand is more important to maintaining a balanced supply of homes than the mortgage restrictions.

Call us today to view our new home plans: 713-539-0048 – Sign up for our New Home Buying Tips

Visit our website: www.fairmonthomes.net

Tour our model home – NEW model home coming soon 3903 Whispering Woods – Crystal Lakes Estates

Sorry, the comment form is closed at this time.