Help for Credit Worthy Americans

Big news is circulating the housing sector as six regulatory agencies recently proposed an eased version of the Qualified Residential Mortgage proposal. This new proposal provides more Americans with access to affordable credit while encouraging a reliable, safe financial system. The regulation aligns with the qualified mortgage rule (QM), which—finalized earlier this year–set standards for safe lending.

Big news is circulating the housing sector as six regulatory agencies recently proposed an eased version of the Qualified Residential Mortgage proposal. This new proposal provides more Americans with access to affordable credit while encouraging a reliable, safe financial system. The regulation aligns with the qualified mortgage rule (QM), which—finalized earlier this year–set standards for safe lending.

The proposal drops an earlier made stipulation that lenders keep a stake in mortgages with down payments of less than 20 percent. This effort will make it easier for creditworthy Americans to secure mortgages, as well as discourage risky loans that have contributed to the credit crisis.

“This version of the QRM rule will give creditworthy buyers access to safe and affordable loan products without overly burdensome downpayment requirements,” said REALTOR® President Gary Thomas in a recent statement.

“The new standards, which align with those applied to Qualified Mortgages, are stringent enough to protect consumers from unscrupulous lending practices while also creating new opportunities for private capital to reestablish itself as part of a robust and competitive mortgage market,” Thomas continued.

The regulation was proposed by six government agencies; the Federal Reserve, Federal Deposit Insurance Corp., Department of Housing and Urban Development, Federal Housing Finance Agency, Office of the Comptroller of the Currency, and Securities and Exchange Commission.

Many REALTORS and industry professionals opposed the original QRM rule, proposed in April 2011, as it would have denied millions of Americans access to low cost mortgages, regardless of their sound credit.

“The vast majority of residential mortgages originated and sold by community banks are sold to Fannie Mae and Freddie Mac,” said Camden R. Fine, president and CEO of the Independent Community Bankers of America® (ICBA). According to Fine, the recent actions “would allow many community banks to continue to provide their customers with long-term mortgages. The proposed approach would establish a clear set of rules with fewer impediments to credit availability than the original proposal, which included a 20 percent down payment requirement.”

However, the new proposal isn’t the only option on the table. “In addition to the main proposal that we support today, regulators introduced an unfavorable alternative that would require buyers to put 30 percent down to qualify for a QRM loan, a restrictive measure that dramatically favors the wealthy,” said Thomas.

Many REALTORS® and other industry professionals are discouraging the 30 percent alternative as it would block the majority of the population from becoming homeowners.

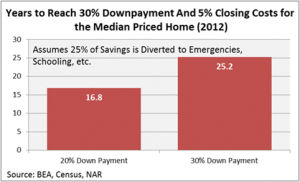

According to NAR, recent research has shown that it would take the average American over 25 years to save enough money to buy a modest home with a 30 percent downpayment.

This alternative is, according to the proposal, not the preferred approach, and the agencies are asking for public feedback on the full proposal by October 30.

Call us today to view our new home plans: 713-539-0048 – Sign up for our New Home Buying Tips

Visit our website: https://fairmontcustomhomes.com/

View Our Communities – View our available new home floor plans – View our photo gallery

Follow Us: Facebook – Twitter – YouTube – LinkedIn – Google Plus

Sorry, the comment form is closed at this time.